🖖 Welcome to Closing The Gap by JVH Ventures. After founding multiple companies and investing into more than 50 startups and 9 funds, we realized that a common understanding between founders, angels, and VCs is often missing.

We want to close this gap and combine perspectives from all sides.

Our goal is to look behind closed curtains and tell the honest truth.

Follow along to gain insights from all directions!

Angel investing is about enthusiasm and supporting founders. But it’s also about money. You are probably in to make a nice return given your bravery of partnering early with startups, right?

Let us know what your return expectations are:

Now let’s get back to reality, by looking into VCs as the professional market makers for the early-stage ecosystem. A VC is normally employing a whole team of partners, investment managers, analysts, and experts. They actively source deals and have mastered their processes. They should be the best in the market to find lucrative startup deals, right?

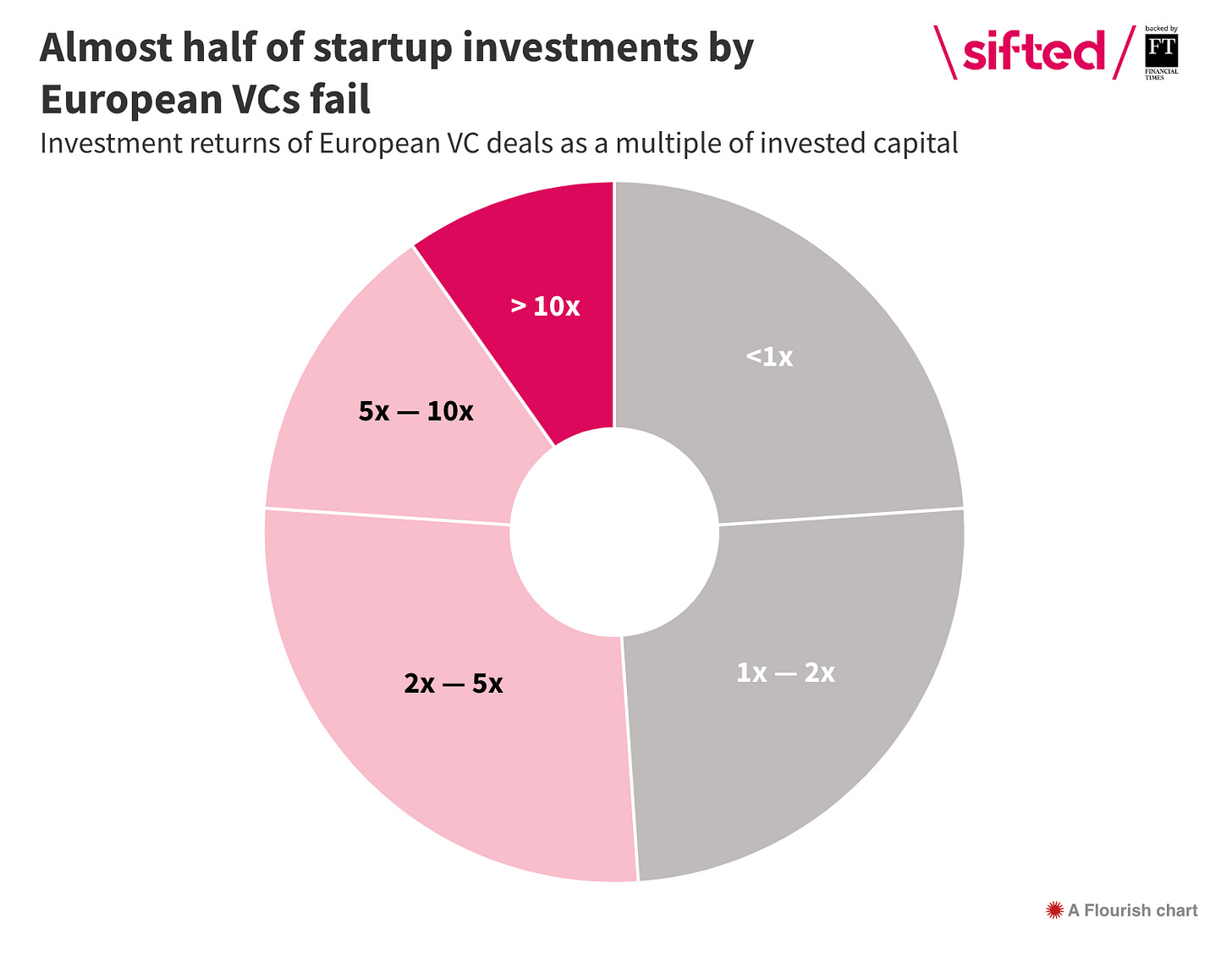

Well, let’s look into their returns as well:

Based on the data provided by sifted, 45% of VC deals make less than 2x. And almost 1/4 (22%) of them is even less than 1x. The ominous 10x that VCs are looking for is found for less than 10% of the deals that they make.

Still think you can beat them?

Well, truth be told: Probably not. Still, us angel investors tend to be fooled by our optimism and also by being somewhat overconfident.

Using realistic failure rates in your daily work

First, try to gather some data from your past investments and the market in general. If you don’t want to or just can’t, take a look at the overall average: Around 80-90% of all startups fail. That’s huge!

We did the exercise of looking in the past ourselves and found out that we have historical failure rate of around 60-70%. Not too bad, but still a significant portion.

Knowing the average failure rate is nice, but what to do about it?

For us this meant introducing risk (or failure rate) into our investment decisions by using our Risk/Return Calculator. Our calculator helps us on a deal-by-deal basis by understanding the financial background of a given startup case.

The goal is to reach a more realistic expectation about the potential return and base our decision upon this, instead of just gut feeling.

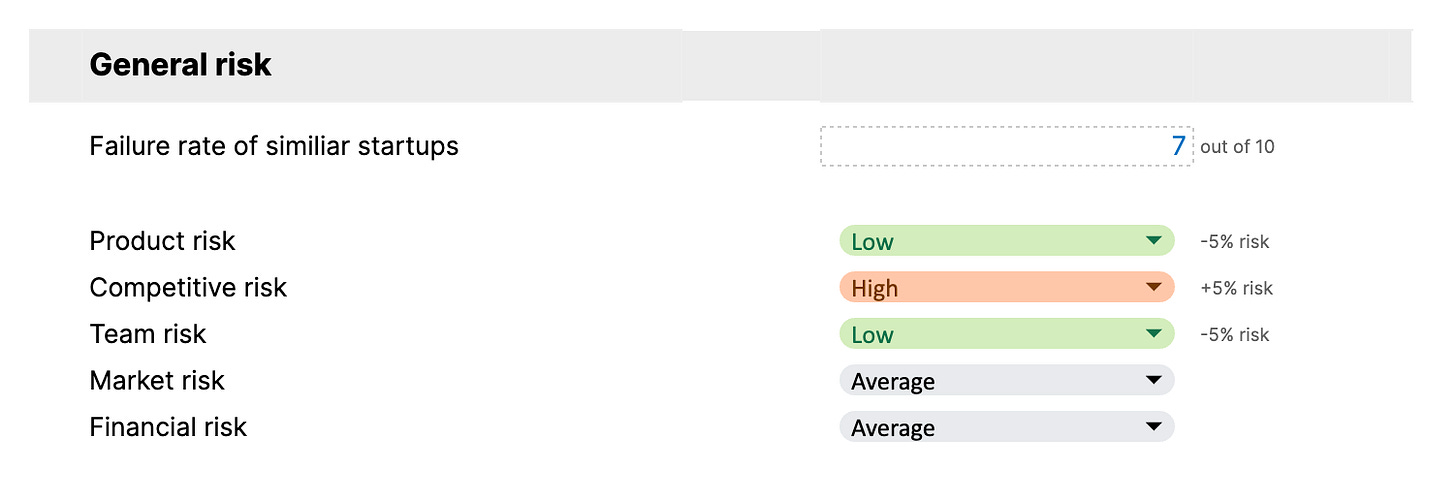

With our calculator, we get an overview like the one below:

By introducing a failure rate (risk factor) the investment in the example, would actually mean that we would not reach much return after all (by assuming an investment of €50k in the example above).

Please note: Our calculator also takes into account other important factors like initially acquired shares, dilution over multiple financing rounds and the exit target.

Calculating expected returns instead of absolute returns

Our Risk/Return Calculator is actually pretty simple.

Step 1: Details of the deal

In a first step, we insert the details of the deal at hand, which looks like this:

Step 2: Return profile

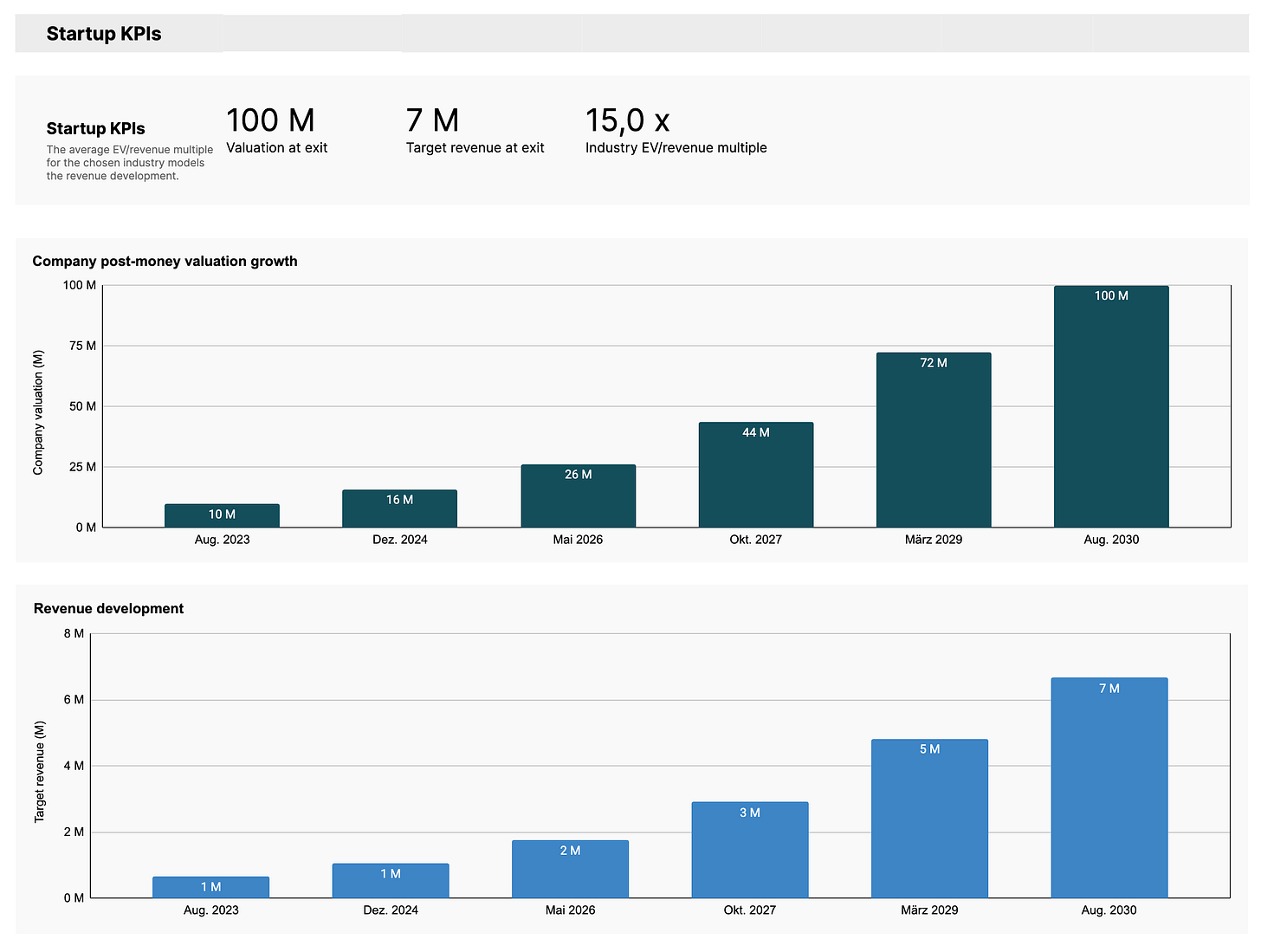

The second step gets a bit more complex, by introducing the future development of returns. Here we take an educated guess of the exit valuation and how the startup gets there. This means both including estimates for the number of financing rounds needed and time until exit. In addition, we assume an average dilution per round.

Mapping out the development over time is of course a wild guess at the beginning, but over time your gut feeling will get more and more precise.

Step 3: Inserting your failure rate

Finally, you can apply your failure rate! We simply feed it into the system and adjust it for every deal depending on the individual risk profile

Step 4: Check your assumptions

Of course, a calculator is just another tool to produce any kind of outcome you want. So it’s important to double-check your assumptions and take any reality check available. Keep in mind, most businesses are actually not unicorns (or 10x) return. Just take a look at the most prominent exits in Germany in 2022 here. Most of them actually are between €100-200m - and these are great success stories!

We are happy to give you sparring around any deal and share our point of view on exit valuations! Feel free to sign up for our Angel Community, where we exchange not just about deals, but also share knowledge (and our calculator).

PS: You get access to our calculator, too!

If you prefer to work on your own, the JVH Risk/Return calculator also produces a rough valuation and revenue development over time for a basic reality check:

What’s next?

Looking into the risk/return equation on a deal-by-deal basis has definitely its downfalls. To be more precise, you have to align your deals with each other, in order to configure a winning portfolio that actually is able to generate returns.

We will share the second part, including pro rata calculation and a guide on portfolio building for angels very soon!

Thank you for reading! If you liked, feel free to share it with someone else who could profit from it - angels, founders, VCs, anyone :)

If you haven’t already, subscribe and make sure you don’t miss out.

PS: We are always happy to answer your questions or take on topics you want to hear about to close the gap! Just let us know.