🖖 Welcome to Closing The Gap by JVH Ventures. After founding multiple companies and investing into more than 50 startups and 9 funds, we realized that a common understanding between founders, angels, and VCs is often missing.

We want to close this gap and combine perspectives from all sides.

Our goal is to look behind closed curtains and tell the honest truth.

Follow along to gain insights from all directions!

In last week’s piece, we discussed the upsides of looking for breakout cases instead of mitigating the downside risk. But what does this imply from a portfolio perspective? Angels are often left on their own to determine their ideal ticket size. We have seen it all. There are tons of arguments for larger tickets and “more control” on the one hand, and on the other, there are angels that totally go for a “spray & pray” approach with a couple of thousands of euros per deal.

Let’s think this through together and see how the power law can help us with portfolio construction.

Ticket sizes vary across angels, especially because of their available budget. To make it easier, let’s look at relative ticket sizes compared to a given budget. Hence, we assume that we have a fixed budget available (e.g., 1 million euros), and we focus on how this cake is divided into ticket sizes.

Larger tickets

Let’s assume that an angel is planning to make 100k euros out of their 1M euros budget, which leads us to a target portfolio size of 10 startups.

Often, we observed this with relatively new angels. As they invest a significant part of their available wealth, they want to feel a sense of control over their investments, both in terms of allocating their attention and also increasing their shares or influence at the startups. Of course, our attention capacity is very limited, and this is also a reason why VCs normally tend to make a limited number of investments in their funds because they need to actively take care of their startups.

Also, fresh angels normally have less deal flow than experienced angels, which can also lead to the logic of aiming for a smaller portfolio with larger stakes per startup.

For angels, this is a very individual decision and everyone treats it differently. However, it’s also extremely important to note that your role is to be the angel here and not the entrepreneur! The founders are in charge and should be perfectly able to build their startup without your help.

Often, angels doing larger tickets are hoping to have bigger kickers in case of the startups’ success, if they deeply believe in it. In some cases, it’s a justification to do larger tickets if the perceived risk of failure and, in turn, the possible return is lower than average.

Last but not least, founders often push for larger tickets. Of course, they would like to have a clean cap table and easier investor relations.

Upside of larger tickets:

The advantages of larger tickets are actually more on the “perceived side”, with little economic benefit from an investor's point of view.

Easier admin and investment effort. Admin can definitely be a nightmare at some point. Especially because you will always spend more or less the same amount of time on a deal, regardless of the ticket size.

More attention per startup. With fewer startups, you simply have more time to help each of them. But from a pure angel investment perspective (not taking into account some hybrid or PE models), often the founders that need you the least, tend to be the most successful ones. We are not talking about providing sparring and feedback here. We love to do this! And this is exactly what angels should be there for.

Avoid pooling. Sometimes a larger ticket can make the difference between being pooled or not. While appearing in the cap table directly is a nice perk, it has little to no economic benefit because pooled investors have the same general rights as non-pooled angels.

Downside of larger tickets:

Less diversification. With fewer eggs in the basket and a relatively high chance of failure, you automatically increase the risk at the portfolio level as well.

Not adhering the power law. While featuring less diversification, a smaller portfolio size also does not follow the rules of the power law and offers less chance to find a breakout case with extremely high returns.

Tendency to optimize for risk. With more control over each startup, investors tend to start actively trying to avoid failure for each of them. While this is very honorable, it makes little sense from a portfolio perspective. You should actually look for the next breakout case instead of trying to mitigate a 50% loss instead of a total failure.

Smaller tickets

As an angel, you have many superpowers from the investor's perspective. Especially, you don’t face the same downsides as VCs do. You don’t NEED to allocate attention to a startup. And you don’t NEED to have a target share per startup. Therewith, you are able to have very large portfolios and even follow a spray & pray approach, which in theory perfectly mirrors the power law.

Please remember, we are not talking about making five small investments here. Instead, following our example from above, we look into deploying our 1 million euro budget with smaller tickets, e.g., making 40 investments of 25k euros per startup.

As a fresh angel, it might (and should) take some time to fully deploy the entire budget. Deal flow will improve over time, but it’s difficult to go on the brakes here. Especially, it requires quite a lot of discipline to follow your ticket size strategy and stay with smaller investments, even if the deal is extremely exciting and feels like a safe bet for a unicorn.

Upside of smaller tickets:

Following the power law. With more investments, you are working towards the power law and increasing both diversification and the chance for breakout returns.

Easier to squeeze into competitive rounds. With smaller tickets, it’s actually easier to get into very competitive rounds. Even if this means you are being pooled.

Downside of smaller tickets:

More work. This is, obviously, probably the largest downside. When making the investment, smaller tickets still require the same amount of work (talking to founders, DD, signing, etc.) and also the same amount of admin effort later on.

Less attention per startup. With more startups, you gradually have less time to help each of them. It’s also harder to keep track of them. However, it should be noted that the 20 investments in our example will be done over time, and once startups emerge (or fail), they will require less of your attention anyway.

Credibility. Following a broad spray & pray approach (e.g., investing just €1000 per deal) will actually not be possible for most angels. First, startups generally also want skin in the game, which is completely understandable. Hence, working with too few tickets can actually eat up your credibility and lead to less or inferior deal flow.

What portfolio performs better?

Now let’s compare the two resulting portfolios. For larger tickets, a lot of angels also expect higher returns - especially if they really, really believe in the case at the beginning. While this can be true in individual terms, the view changes with the portfolio perspective, which incorporates the risk of failure.

To illustrate this for you, we used our own return data at JVH Ventures and ran some portfolio simulations for our two example portfolios of 10 vs. 40 investments (e.g., 100k€ vs. 25k€ ticket size). To see the return differences, we used a Monte Carlo simulation with 5000 simulated portfolios based on the actual return data of our own portfolio. While this approach has some flaws (see below), it shows the general mechanics of how 5,000 simulated portfolios perform when we change the number of investments in the portfolio.

See our return structure in our last article.

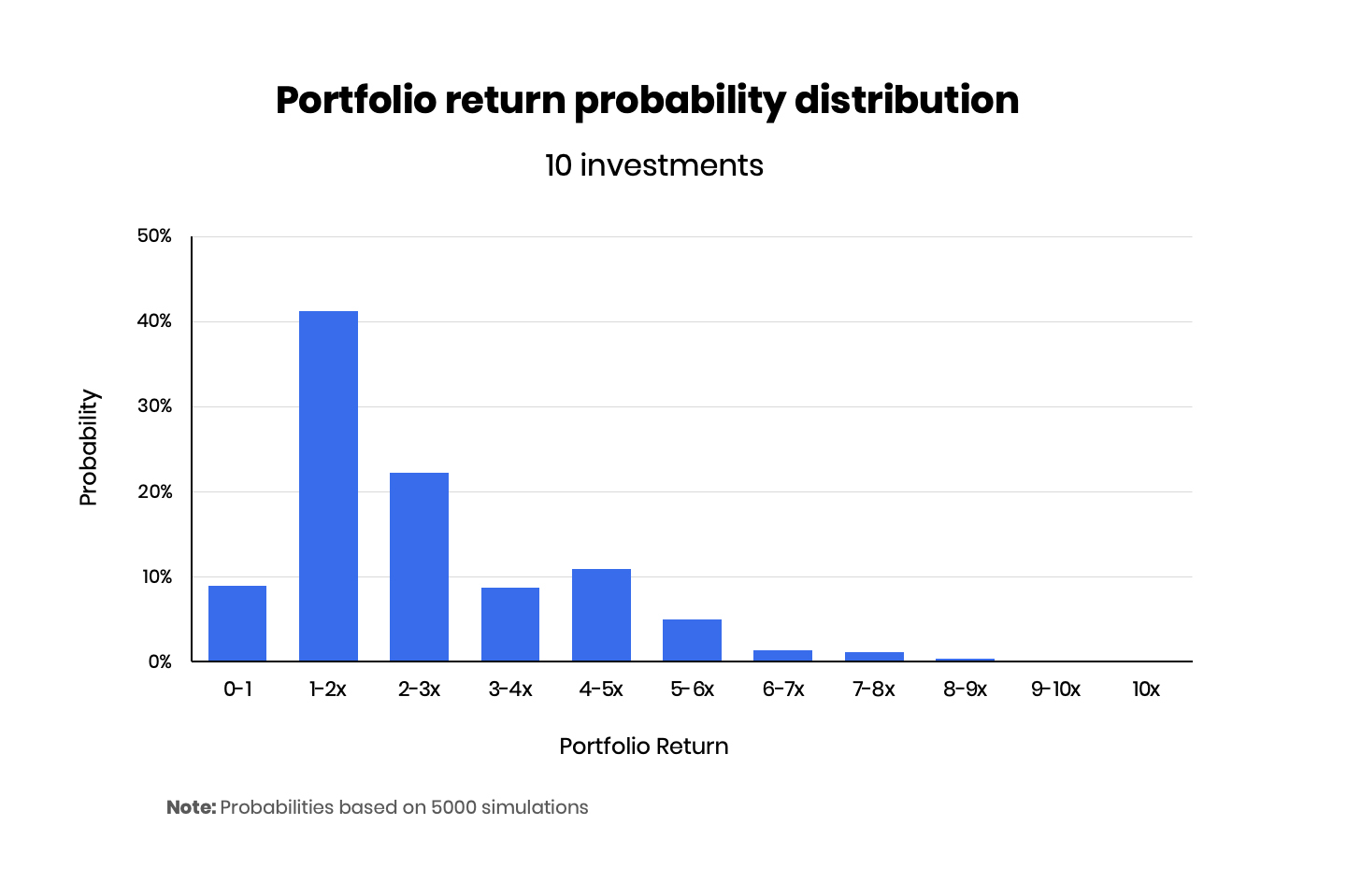

First, we look at our smaller portfolio. Here we see how the 5000 simulated portfolios with 10 investments are distributed over different returns.

Interestingly, we see a lot of variability, including an almost 10% chance of losing money.

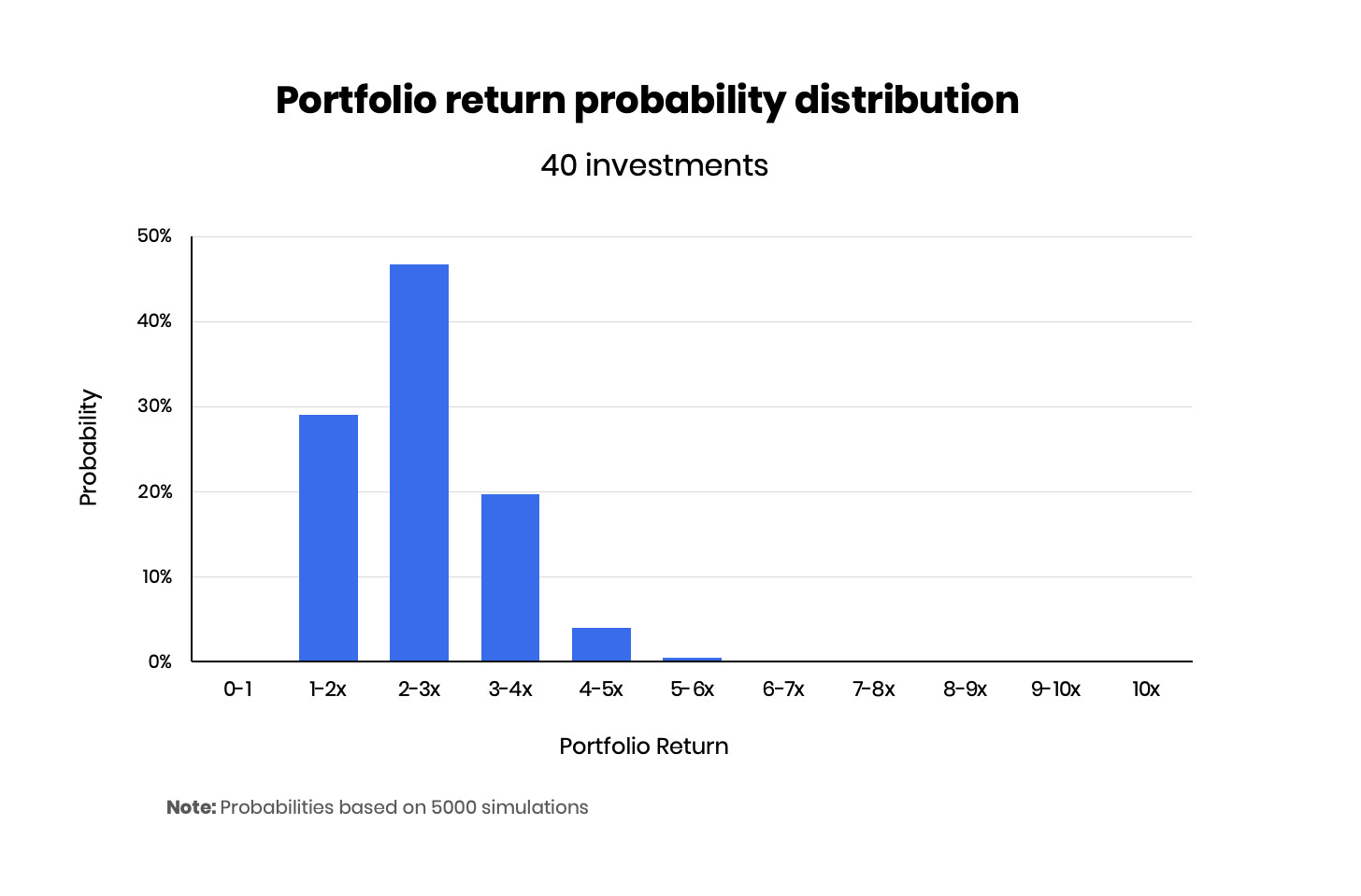

To compare this, here are the results of our 40 startup portfolio. Directly, we see less variability and almost eliminate the chance to lose money at the portfolio level. With 40 investments, our chance of achieving more than 2x returns increased by 23%, to a probability of 71%.

Hence, in general, the probability of earning larger returns is higher for a larger portfolio while simultaneously decreasing the chance of losing money. It’s important to note that the mean return is almost the same for both, while variability is different, and hence both approaches inherit different risk factors.

We must admit that using a Monte Carlo simulation is not the best way to look at startup portfolios. While it is a helpful tool to display the general mechanics, a Monte Carlo simulation depends on the data provided, and as we did not make any 10.000x investment (e.g., Google Seed Round), the potential of extreme breakout cases is not incorporated.

The so-called fat tail of the Power Law distribution can actually make a large difference for the returns, but it is not incorporated in our simulation. Actually, the fat tail can also be described with Nassim Taleb’s expression of “Black Swans” from his famous book - something (great or bad) that you did’t see coming.

But of course, this logic would only increase the difference between the two portfolios in favor of the larger one: if we have more shots, it gets more likely to land somewhere on the fat tail.

Generally, we can see from the simulation that the larger the portfolio, the lower the statistical variability (especially regarding the risk of failure) and the higher the chance to land on the fat tail, which means a higher likelihood of large returns.

If you want a more in depth look into portfolio simulations yourself, have a look Jerry Newmann’s Blog.

What’s next?

How do you actually construct your optimized personal portfolio? How do you diversify startup investments and what number of startup investments is the best for your budget.

Check out Portfolio Building Part 2 to find out how to set your sweet spot

Thank you for reading! If you liked, feel free to share it with someone else who could profit from it - angels, founders, VCs, anyone :)

PS: We are always happy to answer your questions or take on topics you want to hear about to close the gap! Just let us know.