🖖 Welcome to Closing The Gap by JVH Ventures. After founding multiple companies and investing into more than 50 startups and 9 funds, we realized that a common understanding between founders, angels, and VCs is often missing.

We want to close this gap and combine perspectives from all sides.

Our goal is to look behind closed curtains and tell the honest truth.

Follow along to gain insights from all directions!

Last week, we hosted the third edition of JVH Backstage. While this aims to bring together the portfolio companies on the one hand, we also tried to “close the gap”, by inviting a small, selected circle of angels and VCs as well. Within this small group, we discussed real challenges and perspectives openly and honestly.

A controversial topic that came up, was a discussion around risk and return.

While some of the attendees thought a lot about how to assess risk the right way, a renowned VC partner said: “We try not to look into the risk too much. Actually, we try to abandon ‘risk’ as a word entirely in our process. Instead, we look into a startup’s breakout potential.”

But is this really a clever strategy? And what can angels learn from this take?

About failure and misses

Let’s start with the manifested consequence of risk: Failure. Most of your startup will fail. That’s for sure. The only question is by what probability? For all VCs and also for most angels, failing investments are the largest part of the portfolio. While there are many different statistics, most indicate a general startup failure rate of around 80-90%.

So while failure seems inevitable, all investors still actively try to mitigate it as good as possible. Of course, having some DD process will sort out the obvious flaws from deal flow, but at the very early-stage, it’s also almost impossible to see all potential fallacies that might occur.

As humans, we are heavily driven by loss aversion, which says that losses hurt more than we gain from wins. Hence, it’s deeply embedded in our nature to do what it takes to avoid losses and invest time into identifying potential problems that lead to 100% loss of investment. Even worse, some angels even try to save failing startups and put in a lot of effort to save at least a part of their investment. While this is very honorable and entrepreneurial, it’s also not very logical from an investment perspective, as these “leftovers” will not move the needle in terms of portfolio return.

About hits

“I swing big, with everything I’ve got. I hit big or I miss big.”

Babe Ruth

Now, let’s look into the bright side of life - what happens if you land a hit? The classical VC saying “we are looking for 10x”, reflects at least the general approach they take of identifying outliers or breakout cases. While, many VCs are also falling into the trap of adhering to their loss aversion and following the herd, the most successful funds actually don’t just look for unicorns. They are looking for decacorns.

What this means is best explained by the Babe Ruth Effect. Babe Ruth being a legendary baseball player allegedly once said: “I swing big, with everything I’ve got. I hit big or I miss big.” The most successful VCs try to live by this, because they know that out of 20–50 investments they just need 1-2 to return not just the whole fund, but also generate enough return to satisfy their LPs.

Famous Andreessen Horowitz Partner Ben Evans boils it down to the essence: “The best VC funds don’t just have more failures and more big wins - they have bigger big wins.”

Long rule the power law

The power law is probably very familiar within the entire startup ecosystem. It basically mathematically describes what we discussed before: Just one or a few startups returns all other startup investments - often by several magnitudes. We were eager to see this for ourselves.

Here is what we found.

Looking into the relative distribution of startups in the portfolio across their multiples, we see that most companies trail below 2x, with a substantial amount of companies not even achieving 1x. Luckily, the curve expands gradually until >10x, while becoming very thin. So indeed, we have quite a lot of cases that are not able to generate a substantial return.

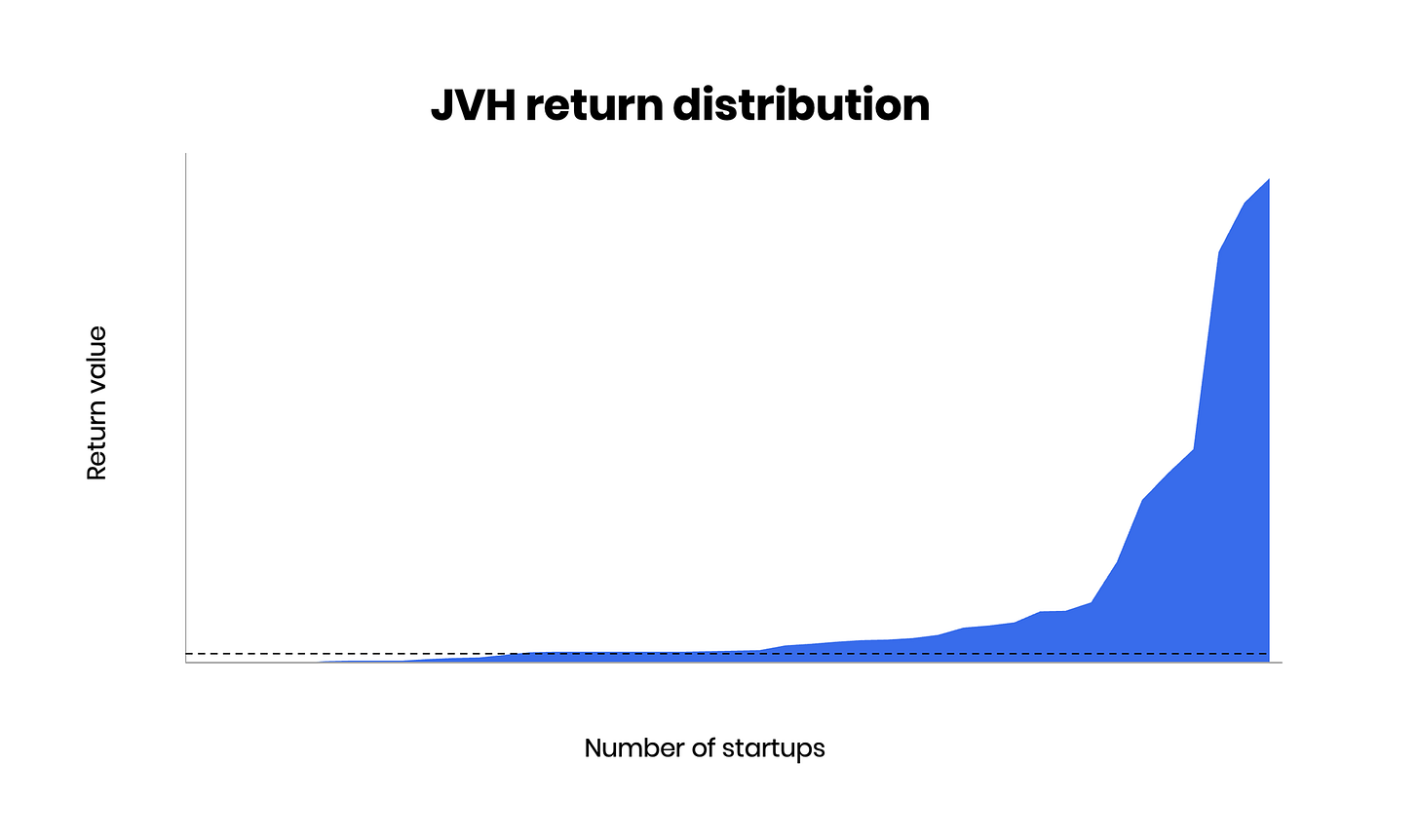

Now, let’s see if the high return cases can actually make up for the others. The second graph is showing the value of our shares in the respective companies, which are located on the x-axis. The dashed line is indicating roughly the average invested amount.

As you can see, the power law holds true for the JVH portfolio as well.

A small number of companies is able to not just return all others, but actually generates substantial returns above the investment as well.

What can angels learn from this?

“We even try not to use ‘risk’ as a word in our startup assessment.”

VC Partner

Actually, the consequences of the well-known power law are often ignored in practice. It teaches us to neglect risk entirely and just look for the big hits. But still, we are looking into all possibilities of what can go wrong, instead of assessing the breakout potential.

Let’s be honest: If you analyze a startup long enough, it will be definitely sorted out in your analysis.

Especially, if you assess the risk factors of potential big hitters, they would probably be sorted out in the process, because of their very nature. Often their markets or categories don’t even exist yet. They address a true vision that can charge a part of the world for good and hence, they might appear a bit out of scope for today’s challenges.

Actually, angels are in a superb position to identify these breakout cases. As an angel, you are able to invest smaller amounts and spread your investment more widely without experiencing many limitations a VC would face with the same logic. In addition, angels are often daring entrepreneurs themselves and have a bold and passionate attitude towards a startup’s vision.

If it comes to being a Maverick or part of the herd - angels should be destined to be true Mavericks.

What’s next?

Is it really wise to follow a pray & spray approach and how big should your ticket size be? We will answer these and more questions in our upcoming series on portfolio building for angels.

Don’t miss out!

Thank you for reading! If you liked, feel free to share it with someone else who could profit from it - angels, founders, VCs, anyone :)

PS: We are always happy to answer your questions or take on topics you want to hear about to close the gap! Just let us know.