🖖 Welcome to Closing The Gap by JVH Ventures. After founding multiple companies, investing directly in 50+ startups and 10+ funds, we realized that a common understanding between founders, angels, and VCs is often missing.

We want to close this gap and combine perspectives from all sides.

Our goal is to look behind closed curtains and tell the honest truth.

Follow along to gain insights from all directions!

Every founder knows them: Operator Angels are entrepreneurs who turned to startup investments. After selling their own companies successfully, they started to focus their investments at what they know best: startups. Given that they lived through the struggle from founding to exit themselves, they are extremely experienced with the entire startup lifecycle on both a professional and personal level.

They also have high industry knowledge, within their respective domains, including a tremendous network, which extends to knowing many other (later-stage) investors.

While some of them just started out with their angel investments, others might be doing it for years already, accumulating vast expertise in startup investments. Being driven as they are, most did not retire after their first venture, but started new projects and companies after their first successful hit. This lets Operator Angels only allocate part of their time towards startup investments and separates them from professional investors in terms of effort they can allocate towards individual deals.

Goals and Challenges

Over-allocation in Startups. Given their background, Operating Angels have the tendency to over-allocate their wealth in angel investments. That might be due to their passion to support new founders, but also because of their potential leverage on this asset class.

Passion to Support Founders (Instead of Strategy): As founders themselves, Operator Angels know how hard it is to start and grow a venture. Hence, they are often driven by their desire to support passionate founders. Many of these sophisticated angels still lack an investment strategy.

Little Time Available and No Processes: As operative founders these angels have a different “main job”, next to their angel activities, leaving little time to sift through deal flow and help the portfolio companies. In addition, most Operator Angels have little to no processes or automations established that could help them to increase their efficiency.

Many Deals, But What About Quality? Many Operator Angels already received a lot of deal flow before they even started angel investment. Well-known entrepreneurs have always been a target for fundraising efforts. Next to their time constraint, they also need to watch out to find true quality in their deal flow. The rational here is to distinguish good from great (not just good from bad).

Little To No DD: Due to their time constraints, Operator Angels mostly never do any form of due diligence. More often than not, they even just subscribe to a round after a short phone call with the founders. Here might be a big window of opportunity, to improve deal selection and quality!

What to Focus On

Holistic Investment Strategy: Next to investing in startups, Operator Angels should see the bigger picture early on. Because of their high risk factor, startup investments should only be a part of the total wealth portfolio. They definitely should consider different forms of asset classes and liquidity options. While it might be too early to think about a single family office, adopting their mechanics is extremely helpful to achieve a diversified and performant portfolio.

Did you know about Cape May Wealth Management?

Jan Voss is a Berlin-based expert in building and consulting angels to progress to a structured Single Family Office.

Jan frequently publishes insightful content around holistic wealth management and investment strategies on his LinkedIn!

Startup Portfolio Strategy: Passion is great, but a portfolio strategy might be even more helpful, if startup investments focus on delivering returns. Starting off by reflecting on their goals, Operator Angels should take a deeper look into the Power Law and its implications for their portfolio. We simulated thousands of return scenarios for two different portfolio sizes with our own return structure. That helped us to set a minimum portfolio size and find the according initial ticket size for our own investments as Operator Angel.

As advanced portfolio building is a topic on its own, feel free to learn more about it in our continuous series about angel portfolio construction.

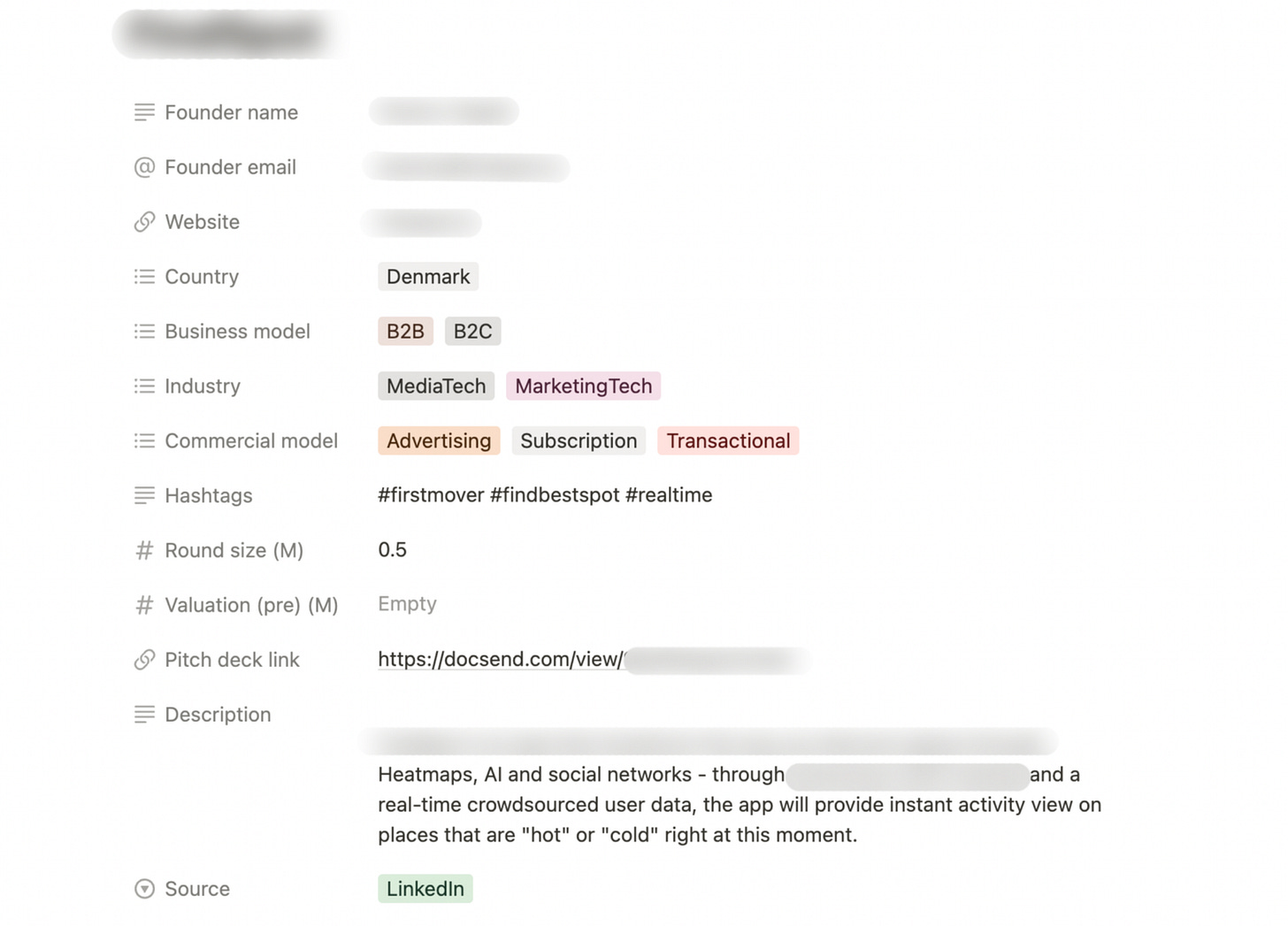

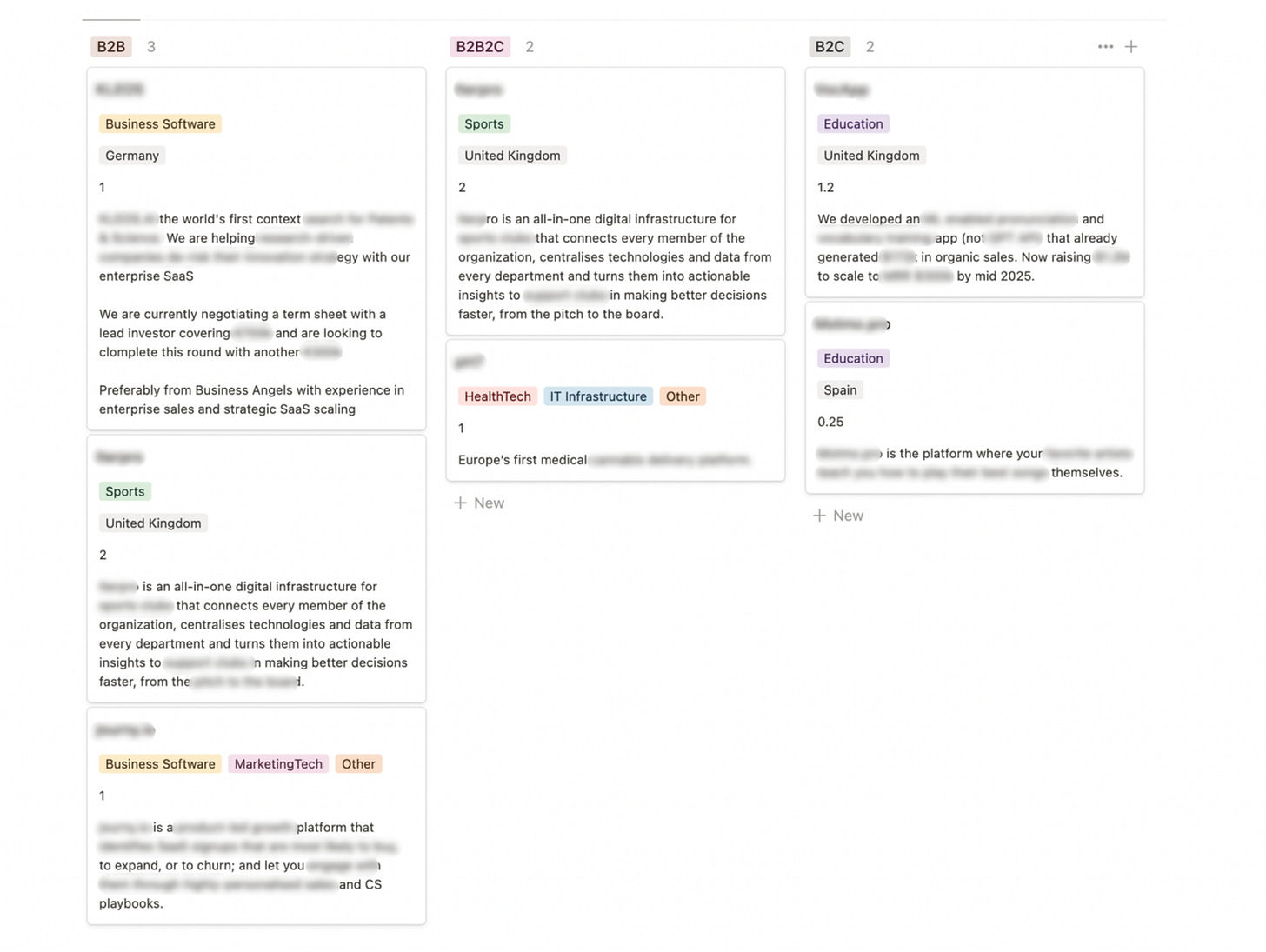

Establish Automatization Processes (e.g. CRM): Automations can be a great leverage to cut through the chaos of analyzing hundreds of pitch decks and managing the communication within deal flow and the portfolio. For example, we built a basic process for our deal flow, where founders submit their pitch via a short survey, which enables us to see all deal information directly in Notion, which we use as deal CRM. So every new deal contains the following information, without any effort from our side:

Also, we built our own tools to track portfolio performance, decide for pro rata, and a radar for upcoming financing rounds within the portfolio.

If you are interested to learn more - just hit us up or join our upcoming angel community:

Building A Brand: Establishing an online presence for their investment activities is still not the standard for many Operator Angels. This includes not just a website, but also having (managed) profiles on Crunchbase, PitchBook, LinkedIn, etc. Even if you have already substantial deal flow, especially the quality will improve with a stronger investor brand. Founder’s are able to get a feeling for the Operating Angel and their investment approach. That definitely leads to higher quality matches than without any branding.

Partnering Up: Operator Angels should not be lone wolves. No one of them built their companies on their own, and still most invest alone. Partnering up with others, getting a working student onboard, or joining an investment club, can all be measures to tremendously improve the investment quality. When you share a deal with others, you not just get deals in return. You also get their helpful opinion and can share DD among more experienced investors.

What we found especially helpful, is to activate our network for more and better deal sharing. Here we try to lead by example and share all of our deals frequently with our network. If you also want to join our deal sharing, let us know and join the waitlist for our angel community above.

Founders Perspective

Let’s face it, Operator Angels are often the prime target for many early-stage founders. They bring a lot of traits of the Expert Angel and also sometimes have high public exposure like Public Angels do. But their main benefit for founders is that they know how it is to build a company, with all it’s good and bad.

Jack Of All Traits: Therewith, Operator Angels can be honest sparring partner in all kind of different situations. From fundraising, to hiring, to mental support throughout the process, many Operator Angels are of great help for many founders. What is important here is to leverage them the right way. We normally say: Let’s talk about your problems, instead of achievements! Especially, many young founders seem to struggle with opening up towards their investors about their challenges, while they are not just the best to help them, but also the ones who will understand.

Reputation: Having an Operator Angel on board has multiple positive signaling effects. They might be widely known in the ecosystem or specific experts on certain terrains. Many other investors, the media, and VCs will recognize these names on cap tables, which adds to a startups own branding for a future financing round, but also for a hiring advantage for example.

Network: Most Operator Angels already have a tremendously well fitting network for the startups they invested in: They know more investors, they can tap into their network for hiring, and sometimes they even have direct access to clients. While founders should not get angels on board just for their network, it can definitely be a great help, especially for later stage fundraising.

What’s Next?

We will explore all angel types in our continuous series. In the meanwhile, feel free to check out our guide on portfolio building for angels and other helpful insights.

Thank you for reading! If you liked, feel free to share it with someone else who could profit from it - angels, founders, VCs, anyone :)

PS: We are always happy to answer your questions or take on topics you want to hear about to close the gap! Just let us know.