🖖 Welcome to Closing The Gap by JVH Ventures. After founding multiple companies and investing into more than 50 startups and 9 funds, we realized that a common understanding between founders, angels, and VCs is often missing.

We want to close this gap and combine perspectives from all sides.

Our goal is to look behind closed curtains and tell the honest truth.

Follow along to gain insights from all directions!

In the first part of this series, we introduced expected returns and how our Risk/Return Calculator simulates your potential returns over time. Of course, this mainly serves as a tool to challenge your assumptions and a help to reflect.

One question that we often ask ourselves is if we should do pro rata? While we used to answer this question with gut feeling, we progressed to also modelling pro rata and its specific effects.

But first, let’s take a step back and look into the fundamentals of pro rata.

Why is it important?

Pro rata is definitely not a must, and for angels it gets too expensive to exercise these rights sooner or later. But it can also be an essential part of your strategy! Pro rata is a part of harvesting your high-risk investment at an early-stage. Growth stage startups with great VCs onboard are not accessible for outside investors with minor check sizes - so here pro rata is a special tool for you to go with lower (RELATIVE!) return, lower risk investments based on your own portfolio.

Of course, absolute returns can still make a great difference at this stage!

Types of pro rata rights

First, having the option to do pro rata is the legal fundamental here. It’s always an essential part of our SHA checklist and grants us the possibility to double down on the winners. Read more about it at our SHA Checklist that we created together with BMH BRÄUTIGAM.

Essentially, there are two options of doing pro rata:

Basic pro rata: This is the normal pro rata, right. You are able to invest as much as it is needed not to dilute in a given round.

Super pro rata: Super pro rata rights offer the opportunity to invest a larger percentage of capital in subsequent rounds than the initial ownership stake. With super pro rata rights, you are able to take on the pro rata rights of other, not-participating investors. This powerful right not only shields against dilution but also allows for the amplification of your stake in promising startups. Here, you have an easy option to extend your shares if someone else doesn’t go ahead with their rights.

Choose your pro rata strategies

From a portfolio perspective, there are three different strategies to do pro rata:

Always do pro rata

Never do pro rata

Do only selective pro rata

For VCs, this is often a fixed strategy which is set from the beginning. With angels, we mostly see option 2. and 3. happening. Interestingly, AngelList performed some analysis on what strategy works best from a portfolio (read: VC) standpoint of view. With their data, both always and never performed best, paying tribute to the power law of venture capital.

From a deal perspective, you also have the option to deploy pro rata in earlier rounds and not pursuing it later, at more expensive rounds - which is something we did historically quite a lot.

Let’s simulate the effects of pro rata

Let’s go back to the investment case example from Part 1.

As a quick reminder, we are looking into the following startup scenario:

Without doing any pro rata, we end up with the following returns.

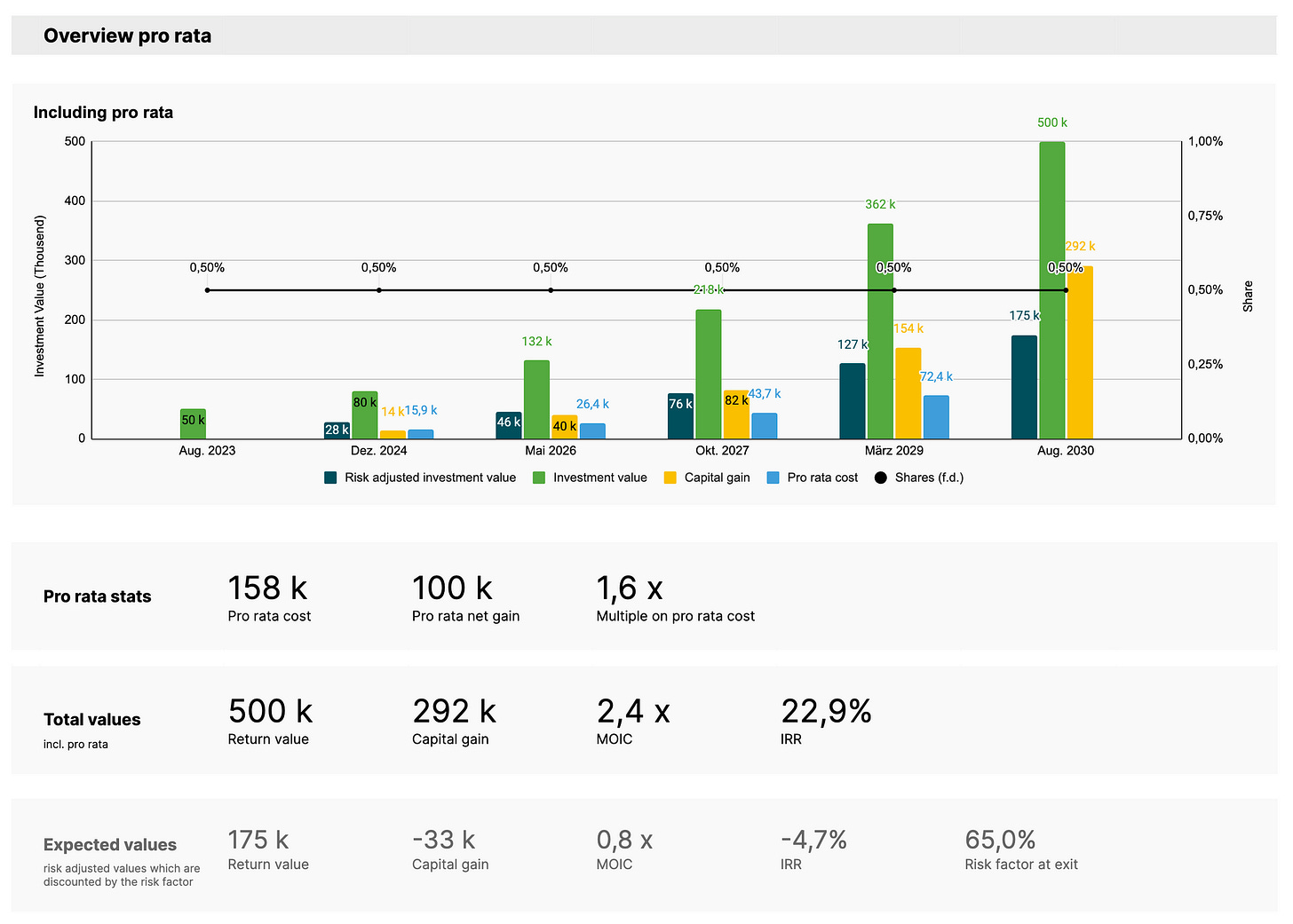

Scenario 1: Full pro rata

Most importantly, we see the projected pro rata cost in our calculator, amounting to €158k deployed in 4 rounds. Of course, the return on these values is declining from round to round, as the case here (not a breakout case) is not growing exponentially. So later round investments do not climb tremendously in their value.

Also, the IRR gets lower as more capital is bound vs. smaller relative development later in the journey. However, there is still a net capital gain of 100k, which amounts to roughly 20% of the total return value.

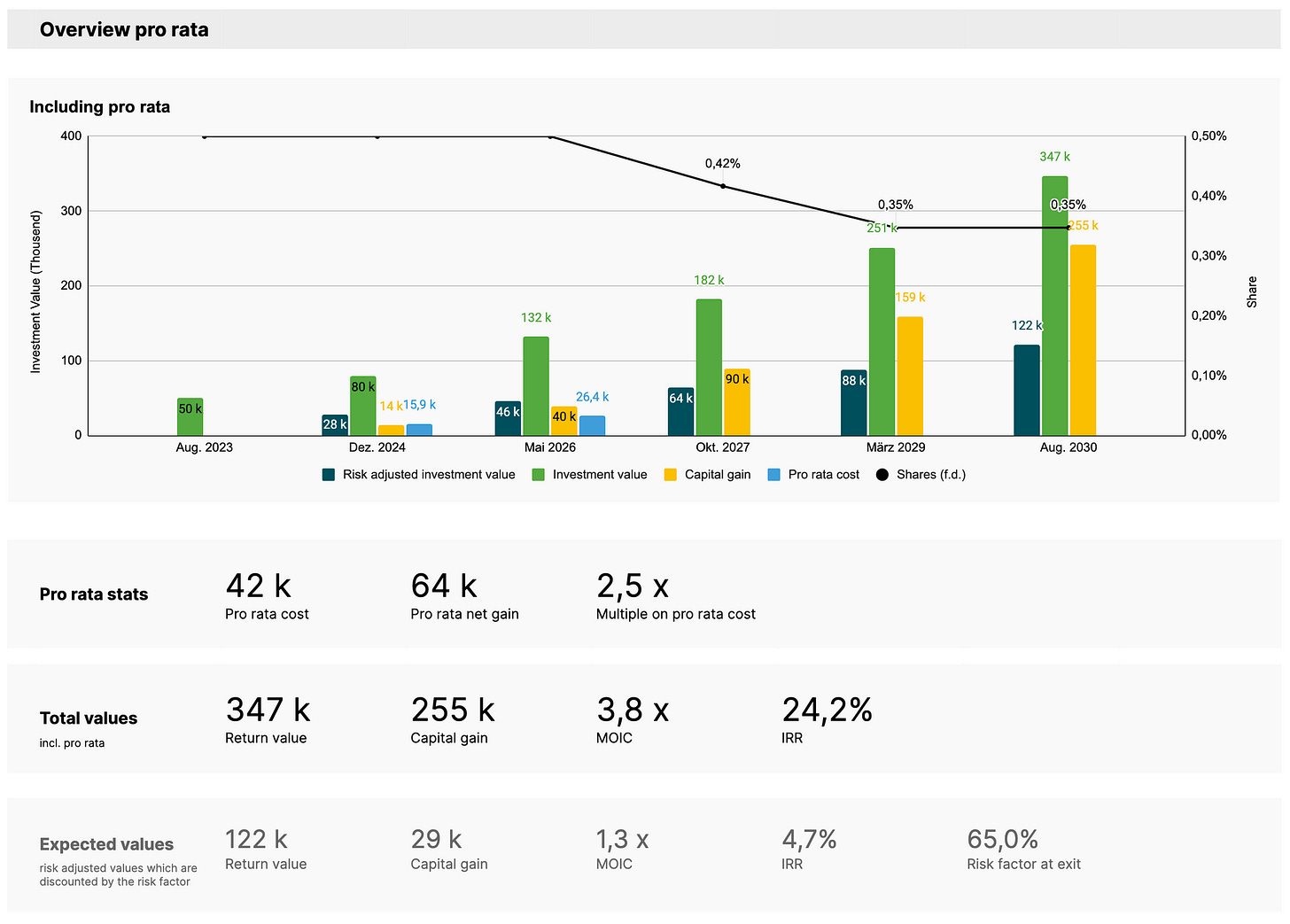

Scenario 2: Partial pro rata

Let’s assume you are just taking on your pro rata rights in the first two rounds and leave it for the last two. Interestingly, the performance for both the IRR and the Multiple gets better significantly. And while the absolute returns are obviously lower, they still make up roughly 18% of the total returns. The total capital gained is just about €40k or 13% lower than before, while your pro rata costs are lower by a staggering 73% (€158k vs. €42k).

So going pro rata in early-rounds, is still providing relatively high additional returns later in the journey.

Scenario 3: Pro rata for breakout cases

Now, let’s assume you really found a breakout case. For easier comparison, we will leave all assumption as is and only increase the return value to €500mn (from €100mn previously).

Going pro rata all the way now looks different somehow:

First, there is quite an amount of capital needed to do this, amounting to €500k of total investment costs. But also we see now a very significant effect on the absolute side of returns. We almost doubled our capital gain from €1.2 million to €2 million! Hence, in absolute terms, the pro rata investment seems to make a big difference for angels!

Conclusion

Pro rata rights are way too important to be ignored by angels. Especially if you sense great traction and valuation drivers early on, it could make a lot of sense to double down on the winners and using pro rata rights.

While there is not one winning strategy, we gained a lot of value from using our Risk/Return Calculator on a deal-by-deal basis to reflect on possible scenarios and compare current opportunities (pro rata vs. new investments).

We will share our Calculator soon with our upcoming angel community.

Feel free to pre-register here:

What’s next?

Looking into the risk/return equation on a deal-by-deal basis has definitely its downfalls. To be more precise, you have to align your deals with each other, in order to configure a winning portfolio that actually is able to generate returns.

Soon we will share the third part, including a guide on portfolio building for angels!

Thank you for reading! If you liked, feel free to share it with someone else who could profit from it - angels, founders, VCs, anyone :)

If you haven’t already, subscribe and make sure you don’t miss out.

PS: We are always happy to answer your questions or take on topics you want to hear about to close the gap! Just let us know.