Our investment process.

At JVH Ventures, one of our primary goals is to foster transparency between investors and startups. We understand that the investment process can often feel like a black box for early-stage founders, so we want to shed light on what you can expect after submitting your pitch deck to us. In this article, we will guide you through the various stages of our assessment and decision-making process, providing insights into our criteria and approach.

Submitting Your Pitch Deck

The first step in our evaluation process is to submit your pitch deck through our website (www.jvh-ventures.com/pitch). There we ask a couple of easy questions with the goal of keeping it as short as possible while providing all the information we need for the screening. The submission took take just 1-3 minutes.

This streamlined process allows us to efficiently gather all the necessary data in one central place. By having all the relevant information together, we can ensure a comprehensive evaluation of your startup.

Also it enables you as the founder to be in full control of the information you provide and the narrative you bring across. In addition, of course you can send us a regular email, but this is rather optional.

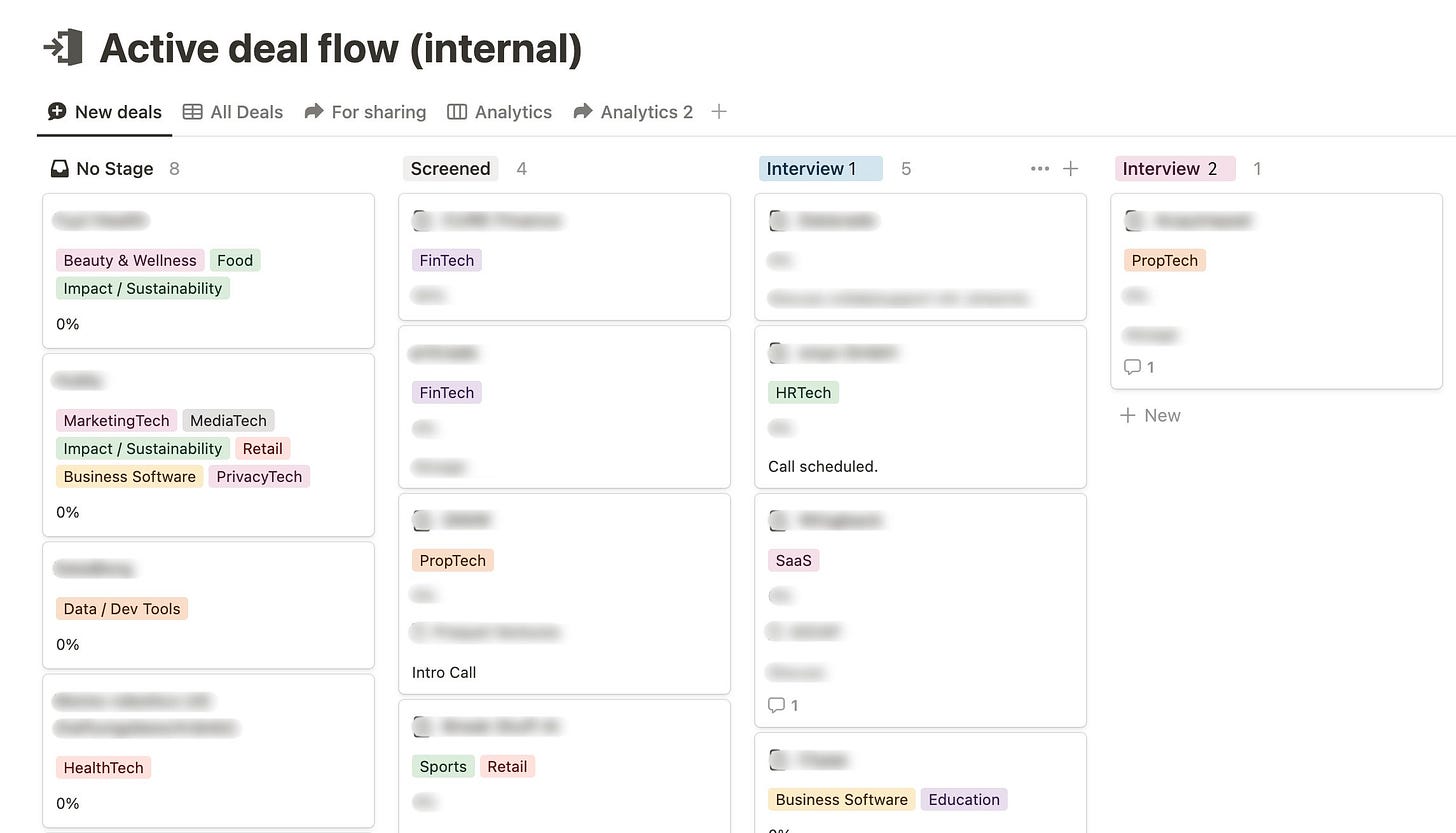

Screening and general matching

After receiving your pitch deck, our team meticulously reviews each deal. During this assessment, we carefully consider our general investment criteria and how well your startup aligns with our overall strategy. See more about our criteria here.

While this initial evaluation may rely on gut feelings to some extent, our extensive exposure to pitch decks enables us to make informed comparisons with other startups in the ecosystem.

We are primarily looking for businesses that have the potential to significantly multiply their valuation, ideally by a factor of 30-60x. This ambition reflects our commitment to supporting startups with substantial growth potential. To learn more about how we evaluate multiples, you can refer to our blog post: "Why 3x is Not Enough Return" on our website.

1st meeting: Getting to Know Each Other

If we find your pitch compelling, we typically invite founders for a first call, lasting approximately 30-45 minutes. This interview is typically a one-on-one conversation between someone from JVH Ventures and one founder.

During this call, our main objectives are to establish a personal connection, gain an understanding of your product and its unique selling proposition (USP), and grasp the dynamics of your target market and go-to-market strategy. Additionally, we delve into your fundraising history, including your current shareholders, cap table, and capital efficiency. Furthermore, we explore your motivations, goals, and the terms of your current fundraising round, as well as your fundraising roadmap for the future.

The focus for us is getting to know you personally while gathering some critical information and asking first questions to ensure our understanding.

Internal Discussion and Additional Questions

Following the initial interview, we initiate internal discussions within our team, which occur at least once a week. During these sessions, we passionately pitch your startup and assess the level of excitement it generates among our team members. We also take this opportunity to challenge your business model and identify any potential gaps or unanswered questions.

Occasionally, we may send you an email with more specific questions, seeking clarification or elaboration on certain aspects of your product or business case. This iterative process allows us to refine our feedback and fill in the gaps that we don’t fully understand.

Investment Memo and Decision

Following the second interview, we debrief and reach a preliminary decision. While we may take additional time to address any remaining questions, we strive to reach a decision quickly.

To formalize our evaluation, we create an investment memo summarizing our thoughts. This document combines insights from our risk/return calculator (see above), which helps us assess whether the investment aligns with our return expectations. Here we run different scenarios on how your company could develop and what this would mean for our potential return.

In addition, we create a startup profile that considers qualitative aspects of the match between your startup and our strategy. The final decision is made collectively as a team.

Finalizing the Agreement (Contract & Sharing)

Once the decision to invest has been made, we proceed to review the contracts and offer to share the deal with our investor network.

Although encountering issues at the contract stage is rare, we have certain expectations that we would like to see addressed in the contract to protect the interests of all parties involved.

Regarding introductions to other investors, we offer to utilize our deal sharing newsletter, which reaches our closest network. Additionally, we often use the target lists of the founders, to make specific introductions, if desired.

Signing

The ultimate confirmation of our commitment is the signed contract. Barring any significant problems that may arise during the final stages, it is uncommon for us to retract our commitment once we have reached this point.

What Happens Afterwards?

After investing in a startup, we take several steps to support our portfolio companies. Firstly, we add the newly invested company to our website's portfolio section, showcasing our commitment to their growth and success.

Some founders choose to celebrate the closing of the deal by organizing a get-together or closing dinner. These gatherings serve as a gesture of appreciation and facilitate connections between new shareholders, fostering potential synergies.

Moreover, many well-organized founders establish a reporting structure, sharing regular monthly updates with us. While we do not require frequent meetings, staying informed through concise updates is always beneficial.

Furthermore, we are dedicated to providing support to our portfolio companies through sparring, input, feedback, and operational assistance to the best of our abilities. We understand the challenges faced by early-stage startups and aim to leverage our expertise and network to contribute to their growth journey.

Are you a founder and currently raising?

Hit us up, we are happy to connect: www.jvh-ventures.com/pitch